Group Homes Are About Operating Cashflow – Not financing or Capital Gains….But if you pay attention to interest rates and are a BUYER of Real Estate – you may want to continue Reading….This is a quick synopsis of how interest rates CAN impact bond prices (and therefore – often REAL ESTATE)

Today’s post is not going to be in depth. We are not going to review procedures or policies for running group homes or assisted livings. If you want that, you can simply sign up for my free TEN PART course which will teach you the step by step ways of making money with group homes

Get Started Now

TODAY’S POST IS ABOUT INTEREST RATES AND THEIR IMPACT ON BOND PRICES

Quick Rule Of Thumb:

A 1% change in interest rates will equate to a price change equal in duration.

For example a 10 year duration will go UP, 10% if interest rates FALL by 1%

The inverse applies as well:

A 10 year duration will go DOWN 10% if interest rates go up by 1%

Remember, these are rules of thumb.

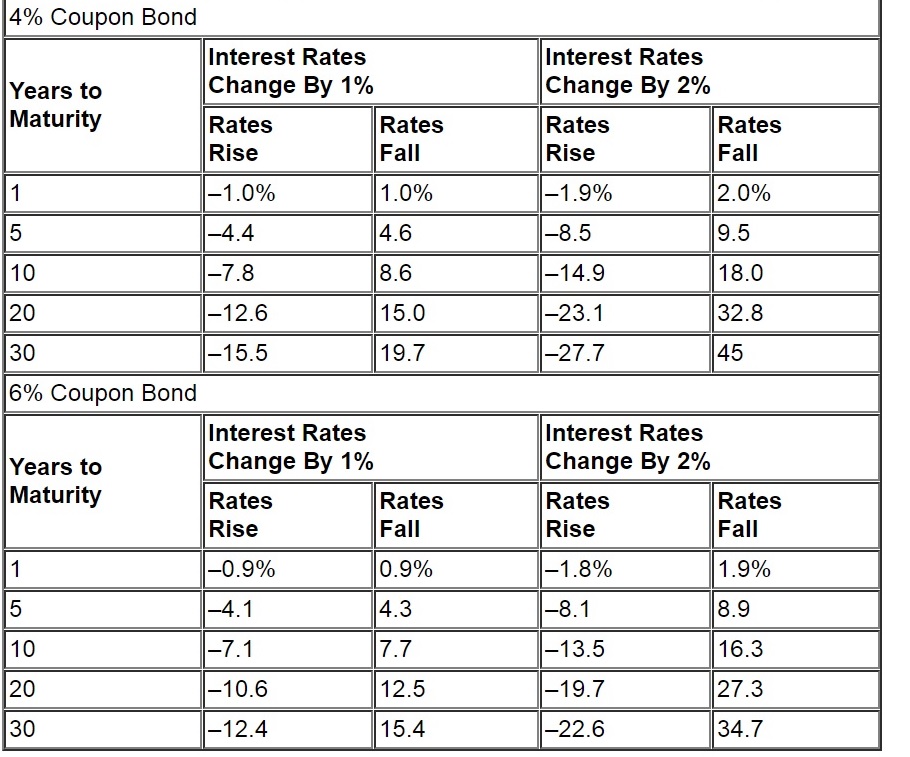

NOW LETS LOOK AT REAL WORLD EXAMPLES

Microsoft sold a 2057 bond (meaning it is DUE in 40 years earlier this month). The yield at inception was 4.5% and at the time, the ten year treasury was at 2.41%.

Currently, the ten year is about 2.88% or about 1/2 a point higher and the microsoft bond price is down about 4.1%. Using the rule of thumb, a .5% increase in rates would = a 5% change in price assuming a 10 year bond. This Microsoft bond issue is 40 years, so I’d like for you to comment on how to better understand this! Again, not all rules of thumb are precisely accurate. That is why they are rules of thumb.

IN MY GROUP HOME BUSINESS, I WOULD RATHER BE ROUGHLY RIGHT THAN PRECISELY WRONG.

I make the above statement because I am not a wall street whiz or trader. I wont teach you how to be either. In fact, quite frankly I don’t know if I really believe the majority of these Hedge Fund guys can really make money on a % basis any better than how I do, or how I teach people to with group homes. Warren Buffet placed a bet with a few of these guys like 10 years ago and asked them to beat the S&P index over a 10 year period. None of them did. Did they get rich in the process? YES! But not from returns. They got rich due to great marketing and taking 2% of assets under mngt and 20% of the upside…..But I digress.

Now lets talk about group homes and what to do if you own the real estate:

Take a look at the chart above to get an idea of how this may affect you if you are a buyer of real estate. Remember, if you can buy LOW, you will have less debt service and therefore a larger monthly profit each month which is the NAME OF THE GAME in the group Home business. You are looking to HELP OTHERS and also MAKE MONEY WITH GROUP HOMES!

SUMMARY:

In the group home business, the lower your monthly payments are for the underlying real estate the larger your monthly profits and FREE CASH FLOW.

If you want to learn how to MAKE MONEY with group homes, assisted livings, foster homes, care homes, ICF or MHMR homes – I encourage you to sign up for my free, 10 – Part Course. I will show you the methods you need to take to get started making money with group homes and how to help others and feel great about what you are doing

Get Started Now