This Blog post will discuss the overall economy and the impact on Group Homes. Quick Tip: The Economy Doesn’t Matter when you own and operate Group Homes Like I Teach….However, If you own the real estate where your Group Home operates – interest rates and the economy may impact your overall wealth…..continue reading to learn why CASH FLOW is the name of the game in the Group Home Business

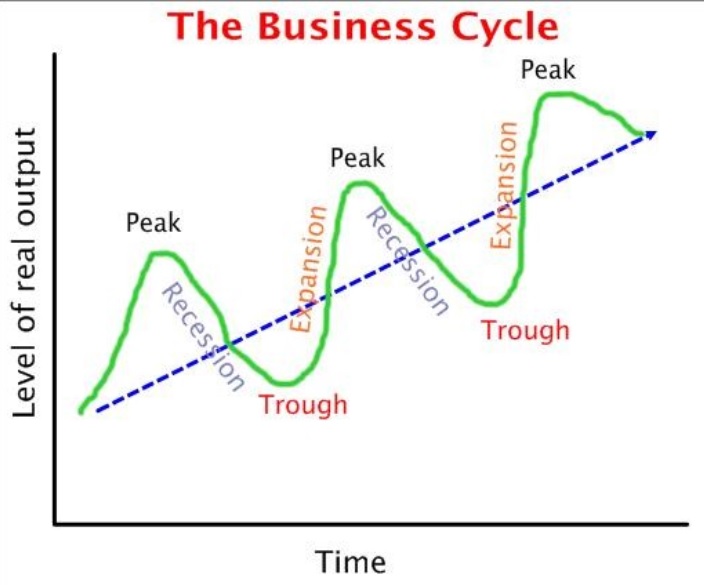

Where Are We in this 2018 business cycle?

Honestly, I don’t know. Quite frankly, if you are running and operating group homes, it really does not matter. The care home, assisted living, sober home, retirement home and other group home type industries literally will not be affected by a downturn in the economy unless the USA turns into Venezuala.

Why?

Because the trend is your friend. Demographics are destiny in today’s assisted living and group home world. Whether you live in Atlanta, Dallas, Los Angeles, Nashville or Miami people are retiring, people are abusing substances and all these people need group homes and care homes where they can live CHEAPLY. Yes, $400 – $800 per month. They will continue paying whether or not the stock market falls. This is what I teach in my free, 10-part course

Subscribe

group home business cycle

BUT WHAT IF I OWN MY REAL ESTATE AND MY WEALTH IS STORED IN REAL ESTATE?

Ok, great question. Look, I am not running a hedge fund or a PE Fund. I am a main street guy off wall street that shows individuals LIKE YOU how to do what I have done. That said, here are my thoughts:

In the later part of the business cycle when the demand from businesses and consumers is picking up at a fast clip – basically faster than businesses have the ability to produce the goods and services wanted or needed prices begin to climb.

EXAMPLE: Housing in a supply constrained area like Northern Ca. Consumers (i.e. tech workers) are making lots of money and builders cannot produce more houses due to land scarcity, lack of labor, material shortages and of course Government Bureaucracy.

During phases like this, the profits become tremendous for builders or others that are producing what the end consumer wants. At that point, the government and the Fed will often get involved to slow down the increase in prices. They do this by increasing interest rates. In fed parlance, this is referred to as Monetary Tightening. This is the opposite of what we say during QE 1, QE2, QE 3 etc. When this happens, the stock values go down as do the value of other assets like real estate and entire businesses.

In the last few weeks, Mr. Market has been teaching those who listen how this works. The economy (from the stats we are provided from the GOVT.) is apparently pretty darn good. So the fed comes in and says, OK, time to lift rates or TIGHTEN. Notice how the stock market has gone down a bit….. Eventually this will cause a downtrend in prices and eventually demand will fall which leads to the next phase:

DEMAND WILL BE SIGNIFICANTLY BELOW THE ABILITY TO PRODUCE (THE OPPOSITE OF THE EXAMPLE GIVEN ABOVE RE: NORTHERN CA. REAL ESTATE)

EXAMPLE: How much can you afford per month if interest rates are 3% VS. 6%?

A million dollar home (give or take) would cost you $3,000 per month VS. $6,000 per month.

THIS IS WHY DEMAND FALLS WHEN INTEREST RATES RISE

At this point, the cycle would start all over again and the Fed would begin reducing rates making assets more affordable again.

This is why it is smart to pick up assets when the economy is weak. In essence, there is excess capacity on the end of the asset owners (think businesses, developers etc). Basically, they have employees to feed and not much demand so they lower prices. THAT IS WHEN YOU WANT TO BUY!

WHY 2018 IS AN INTERESTING TIME

The above is a very simple illustration of how things work. The reality is a bit different for a number of reasons. Here are a few:

- Lower Taxes. You all just saw what happened with the tax bill. AT&T and other large companies are giving out bonuses. This is HUGE

- Monetary repatriation. Trillions of overseas capital could come back to the Unites States

- Interest Rates Are Already SUPER DAMN LOW! Central Banks cannot really lower rates at the moment due to how low they currently are

Obviously, if you hold your wealth in real estate, own a large group home business or other means of production now MAYBE a great time to sell. Especially if you are nearing retirement.

But my method for how to operate Group Homes, Care Homes and other Assisted Living type properties focuses on producing CASH FLOW. Each and every month, my goal is to produce MONSTER TIDAL WAVES of recurring income from these group homes. Do I own real estate? Yes, lots of it. But the cash flow that comes in from the group homes is what allows me to live and be free.

THE END SUMMARY:

Don’t worry too much about the overall economy and the value of your assets. Focus TODAY on getting your group home up and going or expanding your group home empire.

I teach people how to do this in my FREE, 10-Part Course. If you haven’t signed up, I urge you to do this today.